INTRODUCTION

We live in a complicated world, and things that we use everyday work only because thousands of other people make them possible. Consider for a moment your cell phone. Companies make money providing services that make your web surfing possible. People built towers, designed equipment, and program software. Different people make sure our electric system continues humming. There is no way one person could make a cell phone work on his or her own.

Our financial systems are also complicated, and although the Great Depression began nearly a century ago, America’s financial system was complicated even then. Everyday Americans went about their daily lives of school, work, family, friendship and fun in a world that needed bankers, businesses, telegraph operators, and thousands of others to keep the system going.

But things fell apart at the end of the 1920s. Beginning in 1929, the stock market failed, and then banks, farmers, and in the end, stores, factories, and then even schools and churches also ran out of money. It was as if the economy in America was like a house of cards, or perhaps a tower of Jenga bricks that simply could not stand without every other piece being in its exact correct place.

With this picture in mind, think about what happened at the start of the Great Depression and consider your own place in the present world. This is perhaps a scary thing to do as it might leave you feeling out of control but hopefully it will also help you understand how every person is important in making our modern world work.

PRESIDENT HOOVER

Few presidents were as loved as Herbert Hoover, and few were as hated as Herbert Hoover. Before running for president, Hoover had led the project to save foreigners in China during the Boxer Rebellion. At the start of World War I, he led the program to deliver food in Europe. President Woodrow Wilson gave him the job of leading the U.S. Food Administration to organize the rations in America as well as to find food items for the Allied soldiers and people in Europe. As a leader of complicated organizations, he was the best there was, and he had become a hero for saving so many people.

In his first few months as president, Hoover showed that he wanted to fix problems and help people, just like he had in his life before being president. He continued the civil service reform of the early 20th Century by opening more jobs in the government. As the summer of 1929 came to a close, Hoover was a popular leader and it seemed like he was going to go on to many more years of success. However, history now remembers Hoover as one of the worst presidents, and he lost his next election.

THE CRASH

The chance that Hoover had for success as president ended when the stock market lost almost one-half its value in the fall of 1929. Many Americans lost everything they owned. However, by itself the stock market crash itself did not cause the Great Depression that followed. In fact, only approximately 10% of Americans held stock and risked their money in the market. Yet nearly a third would lose all their money and jobs in the depression. The connection between the crash and the difficult years that followed was complicated and involved both big problems that had been growing for years and bad decisions made by leaders.

Although the 1920s were a time when stock prices were going up, in the last four years of the 20s, prices went up much faster and much higher. In an article titled “Everyone Ought to Be Rich,” John J. Raskob told Americans to invest just $15 a month in the market. After twenty years, he wrote, the stocks would be worth $80,000. People all around the nation got excited about stocks. In 1925, the total value of the New York Stock Exchange was $27 billion, but by September 1929, that figure went up to $87 billion. This meant that the average stockholder more than tripled the value of the stocks he or she was lucky enough to own.

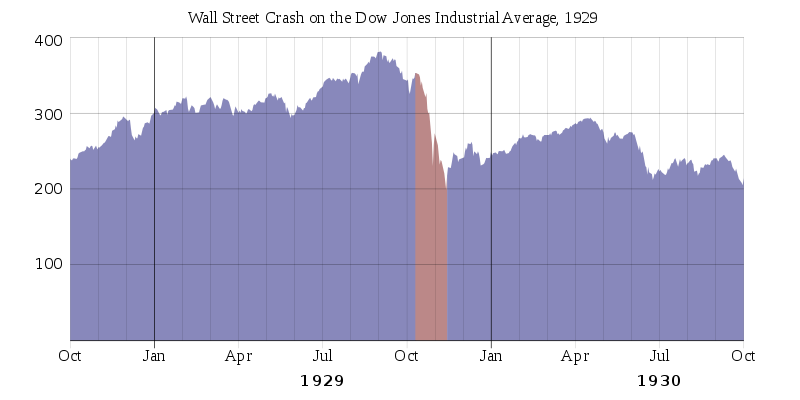

People were able to buy and sell more stock because they bought stock on margin. A margin purchase allowed an investor to borrow money, often as much as 75% of the price of the stock, to buy a lot of stock. Borrowers were often willing to pay 20% interest rates on loans, being certain that the stock would go up in value. Everyone was so sure that the market would go up that borrowing money and buying stocks on margin was common, even though the Federal Reserve Board warned that people could lose a lot of money if the stock market prices went down. Of course, there had to be a limit to how high the market could reach before everyone realized that the stocks were not worth the prices they were selling for. Secondary Source: Chart

Secondary Source: Chart

The crash in the stock market is easy to see in this chart showing the value of the Dow Jones Industrial Average, the average price of major American companies, in the year before and after the crash.

Why do stock prices fall? Although the New York Stock Exchange can be quite complicated, it all works on one simple idea. When investors think a stock is a good value, they are willing to pay more for a share and its value goes up. When traders believe the value of a stock will fall, they cannot sell it at as high of a price. This is the idea that people use every day as they buy and sell stocks and the market works well. However, if all investors think all at once that all the stock prices are too high and try to sell all their stocks at once and no one is willing to buy, the value of the entire market goes down.

On October 24, 1929, a day now remembered as Black Thursday, this is what happened. Everyone tried to sell all their stocks at the same time.

As the market started to fail, banker J.P. Morgan called the other leaders of Wall Street and told them all to buy stocks in the hope of turning things around. But the bottom fell out of the market on Tuesday, October 29. A record 16 million shares were sold for smaller and smaller prices. For some stocks, no buyers could be found at any price. By the end of the day, panic had set in, and for the next few weeks prices fell even more. In a matter of ten short weeks the value of the entire market was cut in half.

For people who had bought stocks on margin, the crash was even worse. After stock prices fell, banks asked people to pay back their loans, and when the borrowers sold back their stocks for less than they had paid, they were left with both the cost of the loan to pay back, plus big interest payments. Instead of making a lot of money, these people had to pay. For people who had bought stock in the 1920s, there was a lot of sadness and suicide.

FARMERS

Most people remember the 1920s as a time when the economy was good right up to the start of the Great Depression, but this is not true. In the second half of the 1920s the economy began to slow down. Fewer jobs were being created and factories were making less.

Most people had lots of money in the 1920s, but farmers did not. During World War I, American farmers saved Europe by growing food to feed the people who had nothing. They also grew enough food to feed America’s army. To do this, farmers had borrowed money to buy new equipment and to plant more land. However, as Europeans went back to their farms after the war and began feeding themselves, and as the government bought less food, farmers found themselves hard hit. No one was willing to pay for all the extra food they were growing.

Basic rules of economics kicked in. The demand for farm products fell as the supply went up. Farmers had to pay back their loans but could not pay. While people in cities were buying new refrigerators and dancing at speakeasies, farmers were losing their farms to foreclosure as banks took the only thing the farmers had left.

Most people do not remember the problems farmers had when they study the 1920s because cars, gangsters, and jazz clubs are so much more interesting, but knowing that the economy was not all perfect helps explain what happened next.

BANK FAILURES

By itself, the crash in the stock market and a slowdown in the economy did not cause the Great Depression. Many stock market crashes have happened that have not led to economic depressions. 1929 was different, however. In addition to the stock market, the Depression happened because thousands of banks across the country failed.

Banks make money by taking in deposits, or money and turning around and loaning that money back out. Borrowers pay interest on their loans, and that is how the bank makes money. Depositors trust the bank to hold their money and give them what they need as they need it. If depositors lose trust in the bank, they will stop giving the bank their money, or worse, try to take out, or withdraw all of their money. Since most of the money has already been loaned out, a bank does not have the cash to give everyone all their money at once. When people started to think that a bank might fail, they would run to their bank in order to withdraw their money when the bank still had some cash left before the other depositors got there. This was a run on the bank, and many banks had to close because of bank runs. Primary Source: Photograph

Primary Source: Photograph

A run on the American Union Bank. Depositors lined up outside the bank waiting to withdraw all of their money. Runs like this became common in 1929 as the economy failed.

Bankers wanted to show that their banks were good companies so that they did not have bank runs. To get more money, they asked people who had taken out loans to pay back those loans early. For stock market investors who had borrowed on margin and had lost money in the crash, this was impossible. Many other Americans were not able to pay back their loans early.

In November 1930, the first major banking crisis began and over 800 banks went out of business by the end of the year. By the end of 1931, over 2,100 banks were out of business. The whole economy started to slow down as 9,000 closed by 1933.

WHAT CAUSED THE DEPRESSION?

Economists do not all agree about the main reason the economy finally failed. The stock market had crashed, and banks were closing, but the economy is complicated, and there are different ideas about what finally led to the Great Depression. The most common ideas come from Milton Friedman, Anna J. Schwartz, and British economist John Maynard Keynes. Primary Source: Drawing

Primary Source: Drawing

A drawing of John Maynard Keynes by Dennis Low. People admired Keynes him for his ideas about the economy, but some people thought he had dangerous ideas that might lead to government take-over.

In his great book “The General Theory of Employment, Interest and Money,” Keynes wrote mostly about how the economy is affected by what people want to buy. Basically, Keynes thought that the Great Depression happened because most Americans started to think that the economy was not good, so they stopped spending their money. As more and more people stopped spending, other people stopped opening new stores, or building new homes or factories. People trying to sell things were not able to sell them, so they lost their jobs. In the end, everyone started to panic and no one was willing to use any of the money they had. Even though there was still the same amount of money in the world, it seemed like there was much less, because everyone was afraid to spend what they had. Friedman and Schwartz called this the Great Contraction and think it is the main cause of the Great Depression. Most economists today think that the Great Depression started like many other recessions, but that things got out of control.

After an earlier economic problem, Congress had created the Federal Reserve Board (Fed), an independent branch of the government that serves as a bank for banks. When times are hard, the Federal Reserve can loan money to banks to stop them from running out of money. However, as the country was getting into the Depression, the Federal Reserve did not deal with the real problem. They saw that the total amount of money had not changed and thought that the economy was still good. But really they were looking at the wrong thing. It did not matter how much money there was, if no one was going to spend it.

Today people think that the Federal Reserve should have stopped banks from failing by printing more money so people would think that there was plenty of money and start spending again. If they had done this, the economic problem would have been shorter and not as bad.

THE SOLUTIONS

Keynes’ basic idea was simple: make sure everyone has a job. To do this, he wrote, governments have to borrow money when the economy is not good and use that money to pay people to do government work. As the Depression went on, President Franklin D. Roosevelt chose to use Keynes’s ideas. According to the Keynesians, this made the economy better, but Roosevelt never spent enough to fix the economy fully. That didn’t happen until the start of World War II.

Milton Friedman, Anna J. Schwartz and people who like their ideas are called Monetarists. They said that the way to fix the problem was by fixing the banks. If the Fed had lowered interest rates and allowed banks to borrow enough money to stop the bank runs, the banking system would not have failed.

Both of these ideas about what started the Great Depression and both ways of fixing the problem have little to do with the stock market, even though the Black Thursday Crash of the market is more famous. As usual, history is complicated.

Everyday Americans did not care what caused the Great Depression. Life was hard no matter what. For us today, we can appreciate the hard work that smart economists such as Keynes, Friedman and Schwartz have done to understand the crisis, and hope that in the future American leaders will learn from the mistakes of the past so that we will never have to live through another Great Depression.

CONCLUSION

Farmers borrowed money to pay for equipment and land to grow food the government needed. Then as the government stopped buying that food, farmers could not pay back the loans. Banks needed cash, but farmers, and then in 1929 people who had bought stock on margin, had no cash to pay.

Banks failed because people lost trust, not just one-by-one, but all at one time. No banker, no matter how smart, could avoid a bank run. Then, as banks failed, the businesses that needed on those banks also failed. Workers found that their favorite stores were closing, and then the workers who had just lost their jobs stopped shopping, leading to more and more bad news.

Looking back at the start of the Great Depression, and at other economic crises that have followed, we can see how small one person is in this great web of cause and effect. We feel a bit like one grain of sand on a beach. Certainly, there would not be a beach without sand, but no one grain seems to make any difference on its own.

So, we can see how other people’s choices, especially when put together, can change on our own lives. And we should think about how our own choices, small though they may seem by themselves, can combine with the choices of millions of others to lead to big changes in the world.

CONTINUE READING

SUMMARY

BIG IDEA: Poor economic decisions in the 1920s led to a financial crisis in 1929, and poor decisions by government officials made the problem worse and turned the crisis into the Great Depression.

President Hoover had been a popular public servant during the 1920s. He was the third Republican president during the 1920s and it seemed like he would be popular as president as well.

When the stock market was doing well in the 1920s, people thought that prices would only go up. To cash in on the opportunity to make money, some investors borrowed money to buy stocks, thinking that they could pay back the money later when the stock price went up. Eventually stock prices fell and these investors lost all their money. Although participation in the stock market increased during the 1920s, only 10% of all Americans had purchased stock. The failure of the stock market in 1929 made the Great Depression worse, but did not cause the Great Depression.

The 1920s was not a good decade for farmers. They had taken out loans to buy new equipment and open up new land for farming during World War I, and when demand fall after the war, they could not pay back their loans.

Some banks began to fail. They made loans that borrowers could not pay. Sensing that a bank was in trouble, people who had depositors ran to a bank to withdraw all their savings. This sort of bank run ruined both well-run and poorly-run banks. When bank failures spread to New York City, the economy failed.

The real cause of the disaster was a failure of the Federal Reserve to respond to the crisis. Instead of supplying banks with funds to continue operation, the Fed held back and the nation fell into the Great Depression.

VOCABULARY

![]()

PEOPLE AND GROUPS

Milton Friedman: Economist who studied the Great Depression along with Anna Schwartz.

Anna J. Schwartz: Economist who studied the Great Depression along with Milton Friedman.

John Maynard Keynes: British economist who proposed the idea that in times of economic recession or depression the government must borrow and spend in order to jump start economic activity. His ideas formed the justification for the New Deal and later government programs such as President Obama’s stimulus.

Federal Reserve Board (Fed): Independent government agency that is responsible for managing the overall economy by serving as the lender of last resort for the nation’s banks.

![]()

KEY IDEAS

Foreclosure: When a bank takes back property such as a house or farm if the owner is unable to repay a loan.

Bank Run: When depositors run to a bank to withdraw all their savings because of a rumor that the bank is failing. The result is that the bank fails since it does not have cash to cover all the withdraws.

![]()

EVENTS

Black Thursday: October 24, 1929, the day the stock market crashed and a traditional starting date for the Great Depression although the crash did not start the depression by itself.